Page 11 - Bespoke EPG 2017 Digital

P. 11

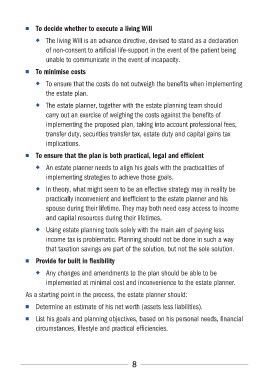

■■ To decide whether to execute a living Will

◆◆ The living Will is an advance directive, devised to stand as a declaration

of non-consent to artificial life-support in the event of the patient being

unable to communicate in the event of incapacity.

■■ To minimise costs

◆◆ To ensure that the costs do not outweigh the benefits when implementing

the estate plan.

◆◆ The estate planner, together with the estate planning team should

carry out an exercise of weighing the costs against the benefits of

implementing the proposed plan, taking into account professional fees,

transfer duty, securities transfer tax, estate duty and capital gains tax

implications.

■■ To ensure that the plan is both practical, legal and efficient

◆◆ An estate planner needs to align his goals with the practicalities of

implementing strategies to achieve those goals.

◆◆ In theory, what might seem to be an effective strategy may in reality be

practically inconvenient and inefficient to the estate planner and his

spouse during their lifetime. They may both need easy access to income

and capital resources during their lifetimes.

◆◆ Using estate planning tools solely with the main aim of paying less

income tax is problematic. Planning should not be done in such a way

that taxation savings are part of the solution, but not the sole solution.

■■ Provide for built in flexibility

◆◆ Any changes and amendments to the plan should be able to be

implemented at minimal cost and inconvenience to the estate planner.

As a starting point in the process, the estate planner should:

■■ Determine an estimate of his net worth (assets less liabilities).

■■ List his goals and planning objectives, based on his personal needs, financial

circumstances, lifestyle and practical efficiencies.

8