Page 67 - Bespoke EPG 2017 Digital

P. 67

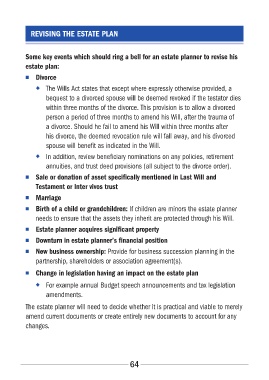

REVISING THE ESTATE PLAN

Some key events which should ring a bell for an estate planner to revise his

estate plan:

■■ Divorce

◆◆ The Wills Act states that except where expressly otherwise provided, a

bequest to a divorced spouse will be deemed revoked if the testator dies

within three months of the divorce. This provision is to allow a divorced

person a period of three months to amend his Will, after the trauma of

a divorce. Should he fail to amend his Will within three months after

his divorce, the deemed revocation rule will fall away, and his divorced

spouse will benefit as indicated in the Will.

◆◆ In addition, review beneficiary nominations on any policies, retirement

annuities, and trust deed provisions (all subject to the divorce order).

■■ Sale or donation of asset specifically mentioned in Last Will and

Testament or Inter vivos trust

■■ Marriage

■■ Birth of a child or grandchildren: If children are minors the estate planner

needs to ensure that the assets they inherit are protected through his Will.

■■ Estate planner acquires significant property

■■ Downturn in estate planner’s financial position

■■ New business ownership: Provide for business succession planning in the

partnership, shareholders or association agreement(s).

■■ Change in legislation having an impact on the estate plan

◆◆ For example annual Budget speech announcements and tax legislation

amendments.

The estate planner will need to decide whether it is practical and viable to merely

amend current documents or create entirely new documents to account for any

changes.

64