Page 32 - Bespoke EPG 2017 Digital

P. 32

9. Property disposed of under and in pursuance of any trust (i.e. donations

made by the trust to a beneficiary)

10. Donations between companies forming part of the same group of companies

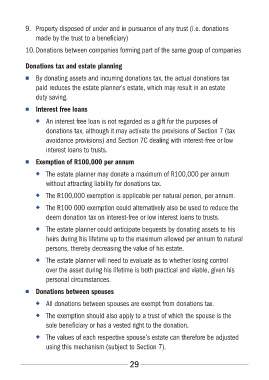

Donations tax and estate planning

■■ By donating assets and incurring donations tax, the actual donations tax

paid reduces the estate planner’s estate, which may result in an estate

duty saving.

■■ Interest free loans

◆◆ An interest free loan is not regarded as a gift for the purposes of

donations tax, although it may activate the provisions of Section 7 (tax

avoidance provisions) and Section 7C dealing with interest-free or low

interest loans to trusts.

■■ Exemption of R100,000 per annum

◆◆ The estate planner may donate a maximum of R100,000 per annum

without attracting liability for donations tax.

◆◆ The R100,000 exemption is applicable per natural person, per annum.

◆◆ The R100 000 exemption could alternatively also be used to reduce the

deem donation tax on interest-free or low interest loans to trusts.

◆◆ The estate planner could anticipate bequests by donating assets to his

heirs during his lifetime up to the maximum allowed per annum to natural

persons, thereby decreasing the value of his estate.

◆◆ The estate planner will need to evaluate as to whether losing control

over the asset during his lifetime is both practical and viable, given his

personal circumstances.

■■ Donations between spouses

◆◆ All donations between spouses are exempt from donations tax.

◆◆ The exemption should also apply to a trust of which the spouse is the

sole beneficiary or has a vested right to the donation.

◆◆ The values of each respective spouse’s estate can therefore be adjusted

using this mechanism (subject to Section 7).

29