Page 47 - Bespoke EPG 2017 Digital

P. 47

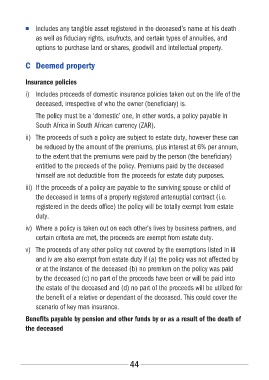

■■ Includes any tangible asset registered in the deceased’s name at his death

as well as fiduciary rights, usufructs, and certain types of annuities, and

options to purchase land or shares, goodwill and intellectual property.

C Deemed property

Insurance policies

i) Includes proceeds of domestic insurance policies taken out on the life of the

deceased, irrespective of who the owner (beneficiary) is.

The policy must be a ‘domestic’ one, in other words, a policy payable in

South Africa in South African currency (ZAR).

ii) The proceeds of such a policy are subject to estate duty, however these can

be reduced by the amount of the premiums, plus interest at 6% per annum,

to the extent that the premiums were paid by the person (the beneficiary)

entitled to the proceeds of the policy. Premiums paid by the deceased

himself are not deductible from the proceeds for estate duty purposes.

iii) If the proceeds of a policy are payable to the surviving spouse or child of

the deceased in terms of a properly registered antenuptial contract (i.e.

registered in the deeds office) the policy will be totally exempt from estate

duty.

iv) Where a policy is taken out on each other’s lives by business partners, and

certain criteria are met, the proceeds are exempt from estate duty.

v) The proceeds of any other policy not covered by the exemptions listed in iii

and iv are also exempt from estate duty if (a) the policy was not affected by

or at the instance of the deceased (b) no premium on the policy was paid

by the deceased (c) no part of the proceeds have been or will be paid into

the estate of the deceased and (d) no part of the proceeds will be utilized for

the benefit of a relative or dependant of the deceased. This could cover the

scenario of key man insurance.

Benefits payable by pension and other funds by or as a result of the death of

the deceased

44