Page 49 - Bespoke EPG 2017 Digital

P. 49

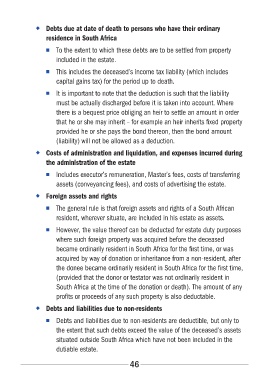

◆◆ Debts due at date of death to persons who have their ordinary

residence in South Africa

■■ To the extent to which these debts are to be settled from property

included in the estate.

■■ This includes the deceased’s income tax liability (which includes

capital gains tax) for the period up to death.

■■ It is important to note that the deduction is such that the liability

must be actually discharged before it is taken into account. Where

there is a bequest price obliging an heir to settle an amount in order

that he or she may inherit – for example an heir inherits fixed property

provided he or she pays the bond thereon, then the bond amount

(liability) will not be allowed as a deduction.

◆◆ Costs of administration and liquidation, and expenses incurred during

the administration of the estate

■■ Includes executor’s remuneration, Master’s fees, costs of transferring

assets (conveyancing fees), and costs of advertising the estate.

◆◆ Foreign assets and rights

■■ The general rule is that foreign assets and rights of a South African

resident, wherever situate, are included in his estate as assets.

■■ However, the value thereof can be deducted for estate duty purposes

where such foreign property was acquired before the deceased

became ordinarily resident in South Africa for the first time, or was

acquired by way of donation or inheritance from a non-resident, after

the donee became ordinarily resident in South Africa for the first time,

(provided that the donor or testator was not ordinarily resident in

South Africa at the time of the donation or death). The amount of any

profits or proceeds of any such property is also deductable.

◆◆ Debts and liabilities due to non-residents

■■ Debts and liabilities due to non-residents are deductible, but only to

the extent that such debts exceed the value of the deceased’s assets

situated outside South Africa which have not been included in the

dutiable estate.

46