Page 21 - Bespoke EPG 2017 Digital

P. 21

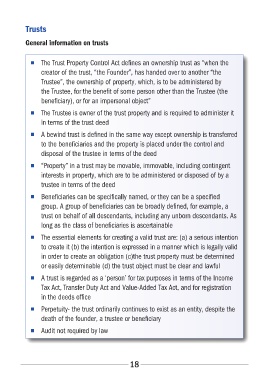

Trusts

General information on trusts

■■ The Trust Property Control Act defines an ownership trust as “when the

creator of the trust, “the Founder”, has handed over to another “the

Trustee”, the ownership of property, which, is to be administered by

the Trustee, for the benefit of some person other than the Trustee (the

beneficiary), or for an impersonal object”

■■ The Trustee is owner of the trust property and is required to administer it

in terms of the trust deed

■■ A bewind trust is defined in the same way except ownership is transferred

to the beneficiaries and the property is placed under the control and

disposal of the trustee in terms of the deed

■■ “Property” in a trust may be movable, immovable, including contingent

interests in property, which are to be administered or disposed of by a

trustee in terms of the deed

■■ Beneficiaries can be specifically named, or they can be a specified

group. A group of beneficiaries can be broadly defined, for example, a

trust on behalf of all descendants, including any unborn descendants. As

long as the class of beneficiaries is ascertainable

■■ The essential elements for creating a valid trust are: (a) a serious intention

to create it (b) the intention is expressed in a manner which is legally valid

in order to create an obligation (c)the trust property must be determined

or easily determinable (d) the trust object must be clear and lawful

■■ A trust is regarded as a ‘person’ for tax purposes in terms of the Income

Tax Act, Transfer Duty Act and Value-Added Tax Act, and for registration

in the deeds office

■■ Perpetuity- the trust ordinarily continues to exist as an entity, despite the

death of the founder, a trustee or beneficiary

■■ Audit not required by law

18