Page 22 - Bespoke EPG 2017 Digital

P. 22

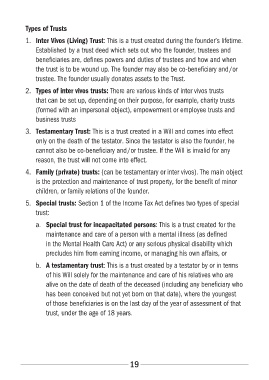

Types of Trusts

1. Inter Vivos (Living) Trust: This is a trust created during the founder’s lifetime.

Established by a trust deed which sets out who the founder, trustees and

beneficiaries are, defines powers and duties of trustees and how and when

the trust is to be wound up. The founder may also be co-beneficiary and / or

trustee. The founder usually donates assets to the Trust.

2. Types of inter vivos trusts: There are various kinds of inter vivos trusts

that can be set up, depending on their purpose, for example, charity trusts

(formed with an impersonal object), empowerment or employee trusts and

business trusts

3. Testamentary Trust: This is a trust created in a Will and comes into effect

only on the death of the testator. Since the testator is also the founder, he

cannot also be co-beneficiary and / or trustee. If the Will is invalid for any

reason, the trust will not come into effect.

4. Family (private) trusts: (can be testamentary or inter vivos). The main object

is the protection and maintenance of trust property, for the benefit of minor

children, or family relations of the founder.

5. Special trusts: Section 1 of the Income Tax Act defines two types of special

trust:

a. Special trust for incapacitated persons: This is a trust created for the

maintenance and care of a person with a mental illness (as defined

in the Mental Health Care Act) or any serious physical disability which

precludes him from earning income, or managing his own affairs, or

b. A testamentary trust: This is a trust created by a testator by or in terms

of his Will solely for the maintenance and care of his relatives who are

alive on the date of death of the deceased (including any beneficiary who

has been conceived but not yet born on that date), where the youngest

of those beneficiaries is on the last day of the year of assessment of that

trust, under the age of 18 years.

19