Page 24 - Bespoke EPG 2017 Digital

P. 24

■■ At least one independent outsider trustee should be co-appointed as trustee

to every trust in which (a) the trustees are all beneficiaries and (b) the

beneficiaries are all related to each other.

■■ A trustee can be a beneficiary of a trust, but a sole trustee may not also be

a sole beneficiary of a trust, as a trustee by definition holds and administers

property for some person other than himself.

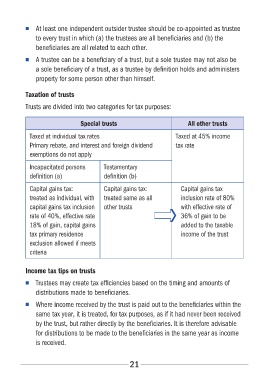

Taxation of trusts

Trusts are divided into two categories for tax purposes:

Special trusts All other trusts

Taxed at 45% income

Taxed at individual tax rates tax rate

Primary rebate, and interest and foreign dividend

exemptions do not apply Capital gains tax

inclusion rate of 80%

Incapacitated persons Testamentary with effective rate of

definition (a) definition (b) 36% of gain to be

added to the taxable

Capital gains tax: Capital gains tax: income of the trust

treated as individual, with treated same as all

capital gains tax inclusion other trusts

rate of 40%, effective rate

18% of gain, capital gains

tax primary residence

exclusion allowed if meets

criteria

Income tax tips on trusts

■■ Trustees may create tax efficiencies based on the timing and amounts of

distributions made to beneficiaries.

■■ Where income received by the trust is paid out to the beneficiaries within the

same tax year, it is treated, for tax purposes, as if it had never been received

by the trust, but rather directly by the beneficiaries. It is therefore advisable

for distributions to be made to the beneficiaries in the same year as income

is received.

21