Page 55 - Bespoke EPG 2017 Digital

P. 55

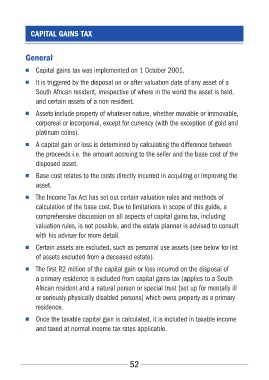

CAPITAL GAINS TAX

General

■■ Capital gains tax was implemented on 1 October 2001.

■■ It is triggered by the disposal on or after valuation date of any asset of a

South African resident, irrespective of where in the world the asset is held,

and certain assets of a non-resident.

■■ Assets include property of whatever nature, whether movable or immovable,

corporeal or incorporeal, except for currency (with the exception of gold and

platinum coins).

■■ A capital gain or loss is determined by calculating the difference between

the proceeds i.e. the amount accruing to the seller and the base cost of the

disposed asset.

■■ Base cost relates to the costs directly incurred in acquiring or improving the

asset.

■■ The Income Tax Act has set out certain valuation rules and methods of

calculation of the base cost. Due to limitations in scope of this guide, a

comprehensive discussion on all aspects of capital gains tax, including

valuation rules, is not possible, and the estate planner is advised to consult

with his adviser for more detail.

■■ Certain assets are excluded, such as personal use assets (see below for list

of assets excluded from a deceased estate).

■■ The first R2 million of the capital gain or loss incurred on the disposal of

a primary residence is excluded from capital gains tax (applies to a South

African resident and a natural person or special trust [set up for mentally ill

or seriously physically disabled persons] which owns property as a primary

residence.

■■ Once the taxable capital gain is calculated, it is included in taxable income

and taxed at normal income tax rates applicable.

52