Page 57 - Bespoke EPG 2017 Digital

P. 57

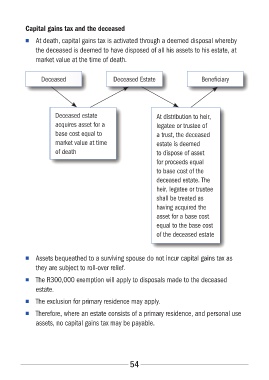

Capital gains tax and the deceased

■■ At death, capital gains tax is activated through a deemed disposal whereby

the deceased is deemed to have disposed of all his assets to his estate, at

market value at the time of death.

Deceased Deceased Estate Beneficiary

Deceased estate At distribution to heir,

acquires asset for a legatee or trustee of

base cost equal to a trust, the deceased

market value at time estate is deemed

of death to dispose of asset

for proceeds equal

to base cost of the

deceased estate. The

heir, legatee or trustee

shall be treated as

having acquired the

asset for a base cost

equal to the base cost

of the deceased estate

■■ Assets bequeathed to a surviving spouse do not incur capital gains tax as

they are subject to roll-over relief.

■■ The R300,000 exemption will apply to disposals made to the deceased

estate.

■■ The exclusion for primary residence may apply.

■■ Therefore, where an estate consists of a primary residence, and personal use

assets, no capital gains tax may be payable.

54