Page 56 - Bespoke EPG 2017 Digital

P. 56

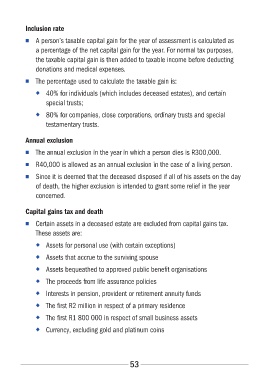

Inclusion rate

■■ A person’s taxable capital gain for the year of assessment is calculated as

a percentage of the net capital gain for the year. For normal tax purposes,

the taxable capital gain is then added to taxable income before deducting

donations and medical expenses.

■■ The percentage used to calculate the taxable gain is:

◆◆ 40% for individuals (which includes deceased estates), and certain

special trusts;

◆◆ 80% for companies, close corporations, ordinary trusts and special

testamentary trusts.

Annual exclusion

■■ The annual exclusion in the year in which a person dies is R300,000.

■■ R40,000 is allowed as an annual exclusion in the case of a living person.

■■ Since it is deemed that the deceased disposed if all of his assets on the day

of death, the higher exclusion is intended to grant some relief in the year

concerned.

Capital gains tax and death

■■ Certain assets in a deceased estate are excluded from capital gains tax.

These assets are:

◆◆ Assets for personal use (with certain exceptions)

◆◆ Assets that accrue to the surviving spouse

◆◆ Assets bequeathed to approved public benefit organisations

◆◆ The proceeds from life assurance policies

◆◆ Interests in pension, provident or retirement annuity funds

◆◆ The first R2 million in respect of a primary residence

◆◆ The first R1 800 000 in respect of small business assets

◆◆ Currency, excluding gold and platinum coins

53